Can You Deposit Dollars At Various Financial Institutions?

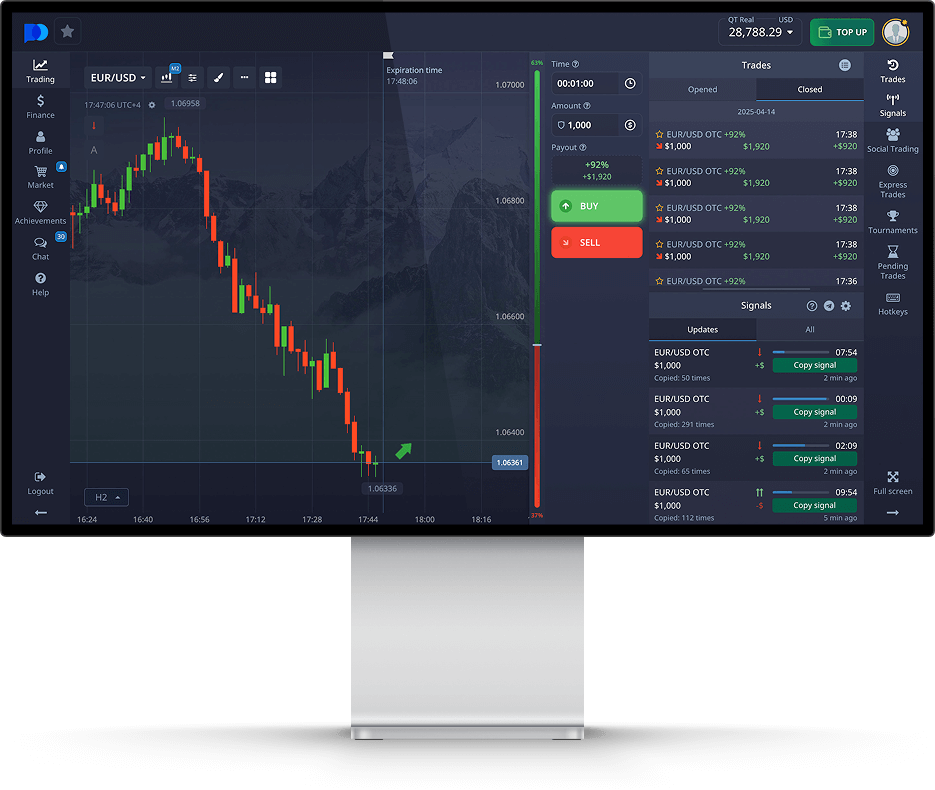

Depositing dollars is a common necessity for many individuals and businesses. In a rapidly evolving financial landscape, knowing your options is crucial. Whether you’re looking to deposit cash into your bank account or move funds online, it’s essential to understand the different avenues available to you. To start your journey, you can check out can you deposit dollars at pocket option https://pocketoption-forex.com/deposit/ for a broader perspective on deposit methods.

The Basics of Currency Deposits

A currency deposit typically refers to the act of placing your cash, checks, or other monetary instruments into a financial institution. This can be done at various institutions, including traditional banks, credit unions, and digital wallets. The security of your money, the ease of access, the fees involved, and the available services should all factor into your decision of where to deposit your dollars.

1. Traditional Banks

Most individuals start their banking journey at traditional banks. These institutions allow you to deposit both cash and checks, providing you with instant access to your funds. The process is straightforward: you can visit a bank branch, use an ATM, or even use mobile deposit features. Banks typically offer a wide range of accounts, from checking accounts where you can easily access your cash to savings accounts designed to accumulate interest over time.

Advantages of Depositing at Banks

- Security: Banks are heavily regulated and insured, meaning your funds are protected up to a certain limit by federal insurance.

- Accessibility: With numerous branches and ATMs, accessing your funds is typically convenient.

- Additional Services: Banks often provide financial services such as loans, mortgages, and investment opportunities.

Disadvantages of Depositing at Banks

- Fees: Many banks charge monthly maintenance fees or transaction fees, which can eat into your savings.

- Limited Interest Rates: The interest on checking and savings accounts may not keep pace with inflation.

2. Credit Unions

Credit unions operate similarly to banks but are member-owned, typically offering more favorable rates and lower fees. They provide a personal approach to banking, promoting community and member-focused services. Depositing money into a credit union can often yield better interest rates on savings and loans.

Advantages of Credit Unions

- Lower Fees: Generally, credit unions charge lower fees compared to traditional banks.

- Higher Interest Rates: Members may receive better savings rates and loan terms.

- Community Focus: Credit unions often prioritize personalized service and community service initiatives.

Disadvantages of Credit Unions

- Membership Requirements: You may need to meet specific criteria to join a credit union.

- Limited Locations and ATMs: Compared to larger banks, their presence may be smaller.

3. Digital Wallets and Online Banks

The rise of technology has also given birth to digital wallets and online banks, creating new ways for users to deposit and manage money. Services like PayPal, Venmo, and apps offered by fully online banks provide convenient options for making deposits without the need to visit a physical branch.

Advantages of Digital Wallets and Online Banks

- Convenience: Easily make deposits and transfers from your smartphone or computer.

- Lower Fees: Many online-only institutions and wallets tend to have lower or no fees compared to traditional banks.

- 24/7 Access: Manage your finances anytime, anywhere.

Disadvantages of Digital Wallets and Online Banks

- Limited Services: They may not offer the full range of services that traditional banks provide, such as physical branches or certain types of loans.

- Security Concerns: Although many digital platforms are secure, they can be more vulnerable to cyber threats.

4. Cash Deposits

For those who prefer handling physical cash, making cash deposits remains an option. Many banks and credit unions allow cash deposits directly at branches or ATMs. Additionally, certain retail locations and services, like convenience stores, may also offer cash deposit services through partnerships with financial institutions.

Advantages of Cash Deposits

- Immediate Access: Cash deposits reflect almost immediately in your account.

- No Digital Dependency: Those who are not tech-savvy or prefer not to use online services can deposit cash directly.

Disadvantages of Cash Deposits

- Safety Risks: Carrying large amounts of cash can be risky.

- Limited Proof: Without a receipt, tracking cash deposits can be harder.

5. Considerations Before Depositing Dollars

Before deciding on where to deposit your dollars, consider the following factors:

- Accessibility: How easily can you access your funds?

- Fees: Are there any maintenance or transaction fees you should be aware of?

- Interest Rates: What are the current interest rates offered on savings or checking accounts?

- Security: How secure is the institution where you plan to deposit your money?

Conclusion

In conclusion, yes, you can deposit dollars at a variety of financial institutions, each offering its own set of advantages and disadvantages. The right choice depends on your unique financial needs, preferences, and lifestyle. Be sure to explore all your options, ask questions, and stay informed about further developments in the financial landscape. Taking these steps ensures that your money is not just safe, but also working for you effectively.