Is Forex Trading Worth It? A Comprehensive Analysis

In recent years, forex trading has become an increasingly popular avenue for investment, attracting both novice and experienced traders alike. With the potential for high returns, coupled with the accessibility offered by online trading platforms, many individuals wonder if engaging in forex trading is truly worth the effort. At the same time, the risks involved and the volatility of the market can be daunting. To help you navigate these waters, we will explore the various aspects of forex trading, including its benefits, risks, and some practical tips that might influence your decision. Additionally, we will highlight resources such as is forex trading worth it Nigeria Brokers for traders interested in the Nigerian market.

The Basics of Forex Trading

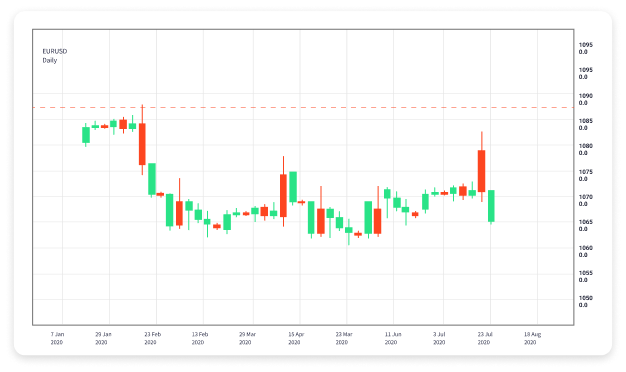

Forex, or foreign exchange, trading involves buying and selling currencies on the global market. Unlike stock trading, which operates on an exchange during specific hours, forex markets are open 24 hours a day, five days a week, enabling traders to engage in trading at almost any time. Currency pairs, such as EUR/USD or GBP/JPY, are the fundamental units of forex trading. Traders speculate on the movement of these pairs, anticipating that one currency will strengthen or weaken against another.

Advantages of Forex Trading

1. High Liquidity

The forex market is known for its high liquidity, with a daily trading volume exceeding $6 trillion. This means that traders can enter and exit positions with minimal slippage, ensuring that they can execute their trades efficiently. High liquidity also contributes to tighter spreads, making trading more cost-effective.

2. Accessibility and Flexibility

Today’s technology allows traders to access the forex market from anywhere in the world with an internet connection. Numerous trading platforms and mobile applications provide users with the tools they need to trade on the go. Additionally, the market’s round-the-clock operations mean that traders can engage in trading at times that suit their schedules, whether early in the morning or late at night.

3. Leverage Opportunities

Forex trading often allows traders to engage in leveraged trades, meaning they can control a larger position size with a smaller investment. While this can amplify profits, it’s crucial to note that leverage also increases potential losses.

4. Diverse Trading Options

Forex trading offers a diverse range of currency pairs to trade beyond just the major pairs like USD/EUR. Traders can explore exotic pairs that may not be as frequently traded, which can lead to unique trading opportunities.

Risks of Forex Trading

1. High Volatility

While volatility in forex can be advantageous, it can also pose significant risks. Currency prices can swing dramatically in response to global economic events, political instability, or market sentiment shifts. Traders must be prepared to handle these fluctuations to avoid substantial losses.

2. Complexity and Learning Curve

The forex market can be complex, especially for beginners. Understanding technical indicators, chart patterns, and economic factors influencing currency prices takes time and effort. Without proper education, traders may find themselves at a disadvantage.

3. Potential for Losses

Forex trading is not a guaranteed way to make money. Many traders experience losses, particularly if they do not have a sound trading strategy or if they succumb to emotional decisions. It is vital to maintain a disciplined approach and understand that losses are a part of the trading journey.

4. Scam and Fraud Risks

The rise of online trading platforms has also led to an uptick in scams and fraudulent schemes. It is crucial for traders to conduct thorough research and choose regulated and reputable brokers to mitigate the risk of falling victim to scams.

Is Forex Trading Worth It?

Ultimately, whether forex trading is worth it depends on various factors, including an individual’s risk tolerance, time commitment, and learning willingness. For those who are disciplined, willing to invest time in education, and manage their risks effectively, forex trading can provide substantial opportunities.

However, newcomers should approach with caution. It is advisable to start with a demo account, familiarize oneself with the market’s nature, and develop a solid trading strategy before venturing into live trading. Continuous education and research into the forex markets, economic factors, and effective trading tactics will contribute to long-term success.

Conclusion

In conclusion, forex trading holds the potential for significant profits, but it is not without its challenges and risks. The decision to engage in forex trading should stem from informed choices and a clear understanding of its intricacies. With thorough preparation and the right mindset, you can enhance your chances of achieving success in the forex market.

Additional Resources

For those who are looking into the Nigerian forex market, consider exploring reputable brokers such as Nigeria Brokers, which can provide insights and tools to enhance your trading experience.